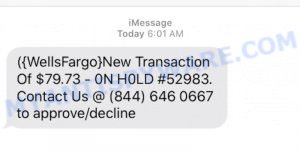

In today’s digital age, scams and frauds have become increasingly common, and cybercriminals are constantly finding new ways to target unsuspecting victims. Just a few months after we reported on a scam using fake messages from Wells Fargo, a similar phishing scam has emerged, this time targeting customers of PNC bank. The scammers use fraudulent messages that appear to be from PNC bank, asking the recipient to approve or decline a suspicious transaction. These messages contain a phone number that the recipient is instructed to call, which can lead to the scammers gaining access to sensitive personal and financial information. In this article, we will take a closer look at this latest scam and provide tips on how to protect yourself from falling victim to it.

QUICK LINKS

- Approve/Decline PNC Scam Explained

- What to do if you receive the PNC Scam text?

- Here are 5 tips on How to Spot Such Scams

Approve/Decline PNC Scam Explained

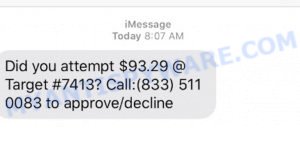

The PNC Approve/Decline Scam is a phishing scam where scammers send fake text messages to PNC Bank customers, claiming that there has been an attempted transaction on their account that needs to be approved or declined. The messages will usually ask the recipient to call a phone number to confirm the transaction. Once the victim calls the number, they will be connected to a scammer posing as a PNC Bank representative who will try to steal their personal and financial information.

Example #1:

Did you attempt $34.12 -Call 18058738799-Exxon Mobil?) to approve or decline.

In this example, the scammer is posing as PNC Bank and claiming that there has been an attempted transaction of $34.12 with Exxon Mobil that needs to be approved or declined. The recipient is instructed to call the phone number provided (18058738799) to confirm the transaction.

If the victim calls the number, they will be connected to a scammer posing as a PNC Bank representative. The scammer will then ask for the victim’s personal and financial information, such as their account number, password, social security number, or other sensitive details. The scammer may also ask the victim to download remote access software or visit a fake website to “confirm” the transaction, which will then give the scammer access to the victim’s computer and data.

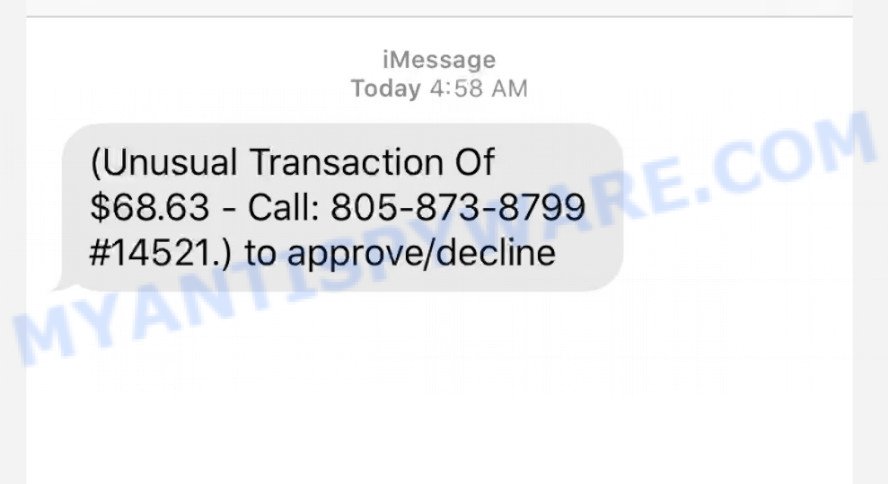

Example #2:

(Unusual Transaction Of $68.63 – Call: 805-873-8799 #14521.) to approve/decline

In this example, the scammer is posing as PNC Bank and claiming that there has been an unusual transaction of $68.63 on the recipient’s account. The recipient is asked to call the phone number provided (805-873-8799) and reference a specific ID number (#14521) to approve or decline the transaction.

Like in Example #1, the victim will be connected to a scammer posing as a PNC Bank representative who will try to steal their personal and financial information.

Example #3:

([PNC] You have one transaction in pending 8058738799 – ID6395) React us to approve/decline

In this example, the scammer is posing as PNC Bank and claiming that there is a pending transaction on the recipient’s account with a specific ID number (#6395). The recipient is instructed to “react” to the message by calling the phone number provided (805-873-8799) to approve or decline the transaction.

Again, the victim will be connected to a scammer posing as a PNC Bank representative who will try to steal their personal and financial information.

Example #4:

(PNC- New Transaction of $55.42 – Call 8058335580 – us today) to approve/decline

This is a new variant of the PNC Approve/Decline scam where the scammer poses as PNC Bank and claims that there is a new transaction of $55.42 on the recipient’s account that needs to be approved or declined. The recipient is instructed to call the phone number provided (8058335580) to confirm the transaction.

As with the other examples, if the victim calls the number, they will be connected to a scammer posing as a PNC Bank representative who will try to steal their personal and financial information.

Here is a step-by-step breakdown of how the PNC text message scam works

- The scammer sends a text message to the victim’s phone number claiming to be from PNC bank.

- The message informs the victim of a recent transaction that needs to be approved or declined.

- The message includes a phone number for the victim to call to approve or decline the transaction.

- When the victim calls the number, the scammer poses as a PNC representative and asks for personal and financial information such as the victim’s account number, Social Security number, or online banking login credentials.

- The scammer may also ask the victim to transfer money or purchase gift cards to resolve the issue.

- If the victim provides the requested information or follows the scammer’s instructions, the scammer can use it to commit identity theft, steal money from the victim’s accounts, or make fraudulent purchases in the victim’s name.

It’s important to note that PNC Bank will never ask customers to provide their personal or financial information via text message, email, or phone call. If you receive a message like these examples, do not call the number provided or provide any personal information. Instead, call the PNC Bank customer service number on the back of your debit or credit card and report the suspicious message.

Examples of such scams

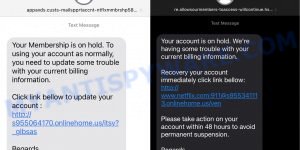

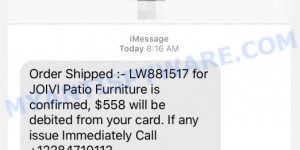

In addition to the PNC scam, there are many other similar scams that use fake text messages to try and trick people into providing their personal and financial information. These scams can be very convincing, using official-looking logos and urgent language to create a sense of urgency and pressure. It’s important to be aware of these scams and know how to protect yourself against them. Below are some examples of similar scams that have been reported recently: Netflix Account on Hold Scam Text, Amazon Account Locked Scam, and Your Apple ID has been locked Scam Text.

- Netflix Membership Account on Hold Scam Text

- Hi mum Im texting you off Scam

- Wells Fargo New Transaction Scam

- JOIVI Patio Furniture scam text message

Remember to always be cautious of unsolicited messages and never provide personal or financial information without verifying the legitimacy of the request.

What to do when you receive a scam text message like the PNC Scam

If you receive a scam text message like the Approve/Decline PNC text message scam, here’s what you should do:

- If you receive a message from PNC bank, verify the message by calling the PNC official customer support number 1-888-PNC-BANK (762-2265) or logging into your account online. Do not use the phone number provided in the message as it is fake.

- Do not respond to the message or call the phone number provided. The scammers may use your response to further scam you or use your contact information for future scams.

- Block the phone number on your phone so you don’t receive any further messages from the scammer.

- Report the scam to PNC bank (forward the message via email to PNC Abuse abuse@pnc.com) and to the Federal Trade Commission (FTC) at https://ftc.gov/. This can help authorities track and investigate the scammer.

- Keep an eye on your bank and credit card accounts for any unauthorized transactions or suspicious activity. If you notice any suspicious activity, contact your bank or financial institution immediately. Use the steps (https://consumer.ftc.gov/articles/what-do-if-you-were-scammed) to try to stop a transaction, get a transaction reversed, or get a refund.

- Share your experience with family and friends to help them recognize and avoid similar scams.

- Use reputable anti-spyware and anti-malware software to protect your computer and mobile devices from malware and other online threats.

- Stay up-to-date on the latest scam and fraud tactics by regularly reading news articles and updates from trusted sources. This can help you recognize and avoid scams before they have a chance to impact you.

Remember, banks will never ask you to provide personal or financial information over text message or email. Always be wary of any unsolicited messages that request this type of information, and take steps to protect your personal and financial information from scammers.

Threat Summary

| Name | Approve/Decline PNC Scam Text |

| Type | SMS Scam, Phishing |

| Fake Claims | Urgent approval or decline needed for a transaction |

| Scammers’ Phone Numbers | 805-833-5580, 805-869-0500, 805-269-8877, 8058738799, 8052698877, 8058335580, 805-873-8799, 8058690500 |

| Damage | Identity theft, financial loss |

| Distribution methods | Nationwide via SMS |

| Indicators of the scam | Urgent language, request for personal and financial information, grammatical errors, or come from an unfamiliar or suspicious phone number. |

| Prevention Tips | Do not respond, contact your bank directly using known contact information, report the scam to your bank and the FTC |

| Reporting info | Report to bank and the FTC, file a complaint with the Internet Crime Complaint Center (IC3) at www.ic3.gov |

Here are 5 tips on How to Spot Such Scams

To spot scams like the PNC text message scam, here are some tips to keep in mind:

1. Be cautious of unexpected or unsolicited messages

Scammers often use unsolicited messages or calls to trick their victims. Be wary of messages or calls that claim to be from a bank or other financial institution, especially if you did not initiate the contact.

2. Check the sender’s information

Scammers often use fake or misleading information to make their messages appear legitimate. Check the sender’s information, including the phone number or email address, to see if it matches the official contact information for the bank or financial institution.

3. Look for spelling and grammatical errors

Many scam messages contain spelling and grammatical errors. This is often a red flag that the message is not legitimate.

4. Don’t give out personal or financial information

Banks and financial institutions will never ask for personal or financial information over the phone or via text message. If you are unsure if a message is legitimate, contact the bank or financial institution directly using the official contact information on their website or on the back of your credit or debit card.

5. Trust your instincts

If a message or call seems suspicious or too good to be true, trust your instincts and don’t provide any personal or financial information. It’s always better to err on the side of caution and protect your sensitive information.

Conclusion

The PNC Scam is just one of many phishing scams that are designed to trick people into divulging their personal and financial information. By being aware of the tactics scammers use and taking the necessary precautions to protect yourself, you can avoid falling victim to these types of scams. Remember to always verify the legitimacy of any text messages or emails you receive from banks or other financial institutions, and never provide personal information unless you’re certain that the message is genuine. Stay vigilant, and help spread the word to your friends and family so that they can protect themselves as well.