Be cautious of the Central Refund Department scam calls, where scammers impersonate representatives from a supposed “Central Refund Department” and claim that your business is entitled to retroactively claim refunds for W-2 employees. These deceptive calls often involve urgent messages and requests to call back a specific phone number. In this article, we’ll expose the details of this scam and provide essential precautions to protect yourself and your business from falling victim to such fraudulent calls.

Quick links

- Signs of Central Refund Department Scam Calls

- How Central Refund Department Scam Calls Work

- What to Do If You Receive Central Refund Department Scam Calls

- Summary table for Central Refund Department Scam

The Central Refund Department Scam Calls

The scam involves scammers calling individuals, often using automated systems, and leaving messages similar to the one below. The message claims that your business is entitled to retroactively claim refunds for W-2 employees for specific years. The scammer provides a phone number to call back and requests that you provide personal or financial information over the phone.

A Central Refund Department Scam Call (Transcript):

Hi Ken Davis doing a follow up call today is Wednesday the 19th. Could you give us a call at our Central refund department. This telephone number is 855-352-2660. Again phone number 855-352-2660. See here that your business should be entitled to retroactively claim the W-2 employees that you had during 2020 2021. If you have a few minutes we need to update you with the total refund amount going back to your business as well as the time you would.

Signs of Central Refund Department Scam Calls

To identify Central Refund Department scam calls or similar fraudulent calls, watch out for the following signs:

- Unsolicited Call: If you receive a call claiming you’re entitled to refunds without any prior communication, it’s likely a scam.

- Urgent Messages: Scammers often create a sense of urgency to pressure you into taking immediate action.

- Requests for Personal or Financial Information: Be wary of calls requesting personal or financial information, especially over the phone.

- Generic Claims: The caller may use vague or generic claims to make the scam sound plausible.

How Central Refund Department Scam Calls Work

The scam starts with scammers leaving automated messages or making live calls to potential victims, claiming that their business is eligible for retroactive refunds for W-2 employees. When the recipient calls back, the scammer may ask for personal or financial information under the guise of processing the refund.

What to Do If You Receive Central Refund Department Scam Calls

If you receive Central Refund Department scam calls or similar suspicious calls, take the following actions to protect yourself and your business:

- Do not provide any personal or financial information over the phone to unknown callers.

- Research the information independently and consult a legitimate financial advisor or accountant before taking any action.

- Block the phone number that called you and report the suspicious call to relevant authorities, such as the Federal Trade Commission (FTC).

- If the call is received at your business, educate your staff about the possibility of such scams and the importance of not sharing sensitive information.

Examples of such scams

Here are some examples of scams similar to the Central Refund Department Call Scam. Officer Schultz Scam Call, United Airlines Refund Scam Call, and Financial Hardship Department Scam Calls, and UR Refund Calls are some of the scams we reported recently.

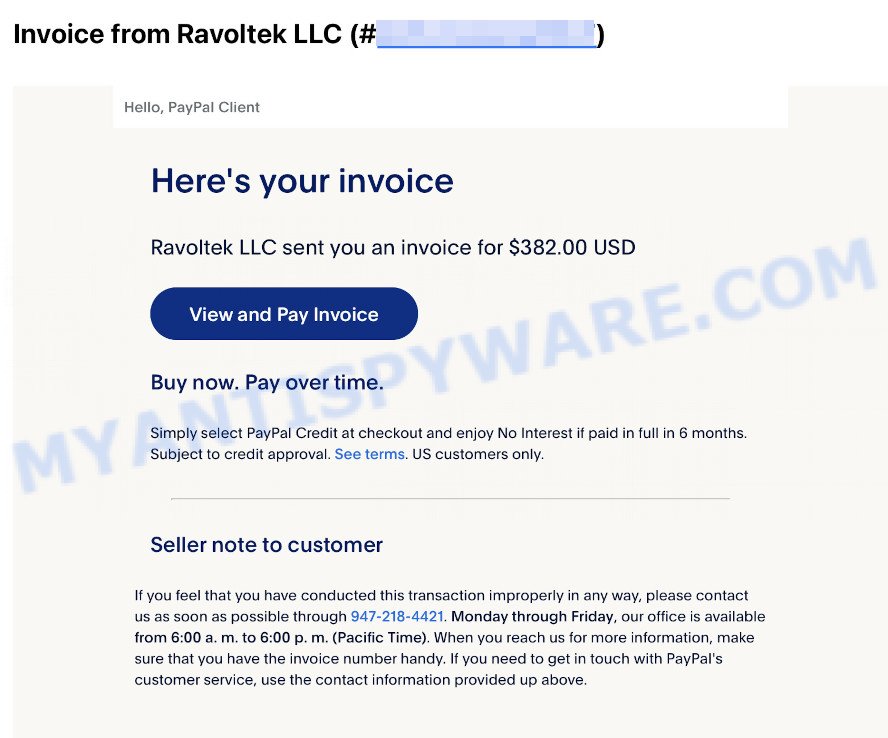

- Ravoltek LLC PayPal Invoice Email Scam

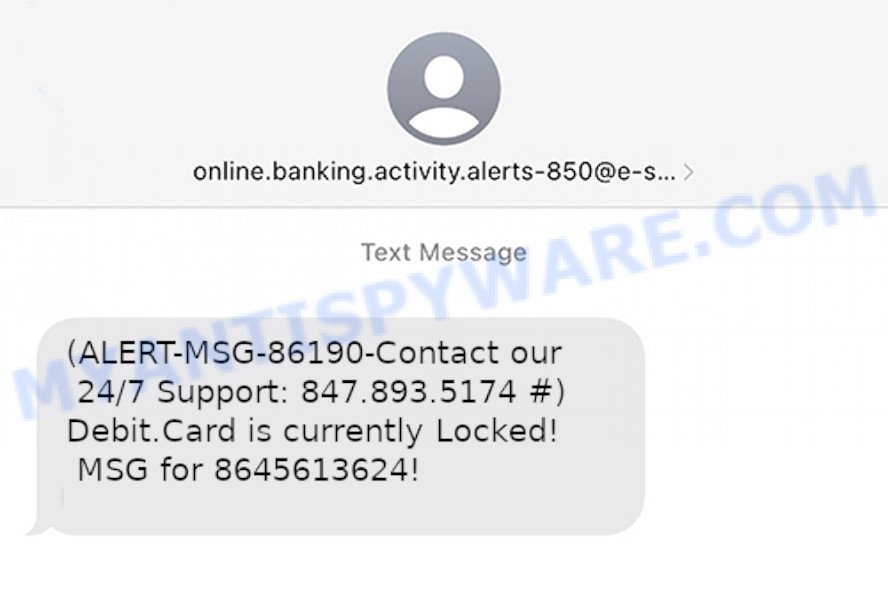

- Online Banking Alert Scam Text 847.893.5174

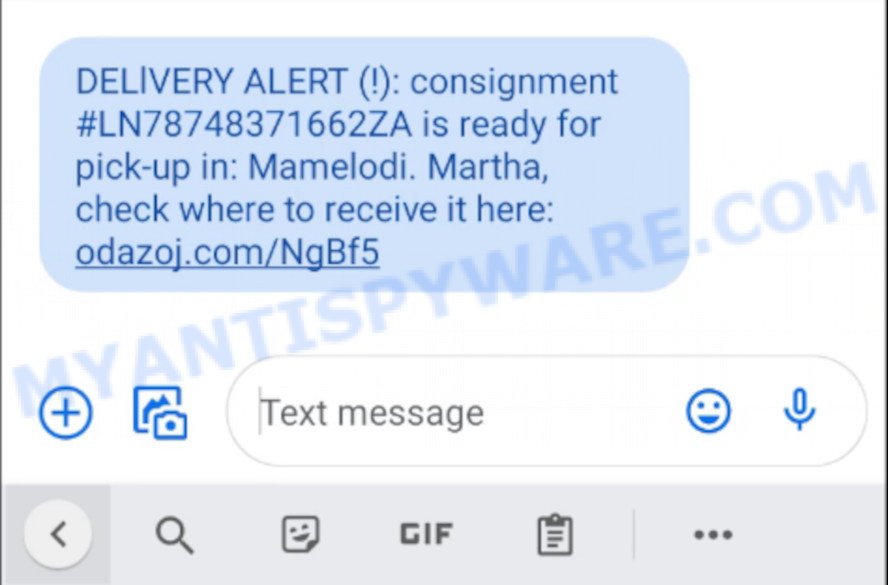

- International Parcel Service Scam text

- Geek Squad Email Scam #1

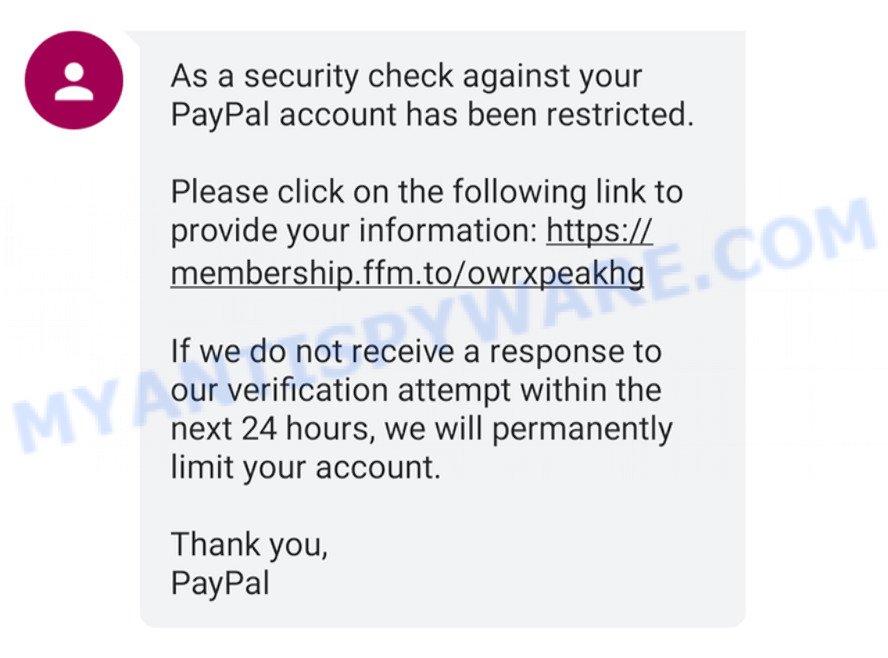

- Security Check Against Your PayPal account Scam

These are just a few examples, but unfortunately, there are many other types of scams out there. It’s important to be vigilant and cautious when receiving any unsolicited communication asking for personal information or payment.

Summary table for Central Refund Department Scam

| Name | Central Refund Department Scam |

| Type | Phone Scam |

| Description | Scammers impersonate representatives from a supposed “Central Refund Department,” claiming businesses are entitled to retroactively claim refunds for W-2 employees. |

| Tactics | Automated or live phone calls, urgent messages, request for callback, claim of retroactive refunds for W-2 employees. |

| Purpose | Obtain personal and financial information for fraudulent purposes. |

| Signs of Scam | Unsolicited calls, generic claims, requests for personal/financial info, urgency. |

| Scammers phone numbers | 855-421-9722, 269-215-8709, 989 244-9117, 947 203-6942, 855-352-2660, 855-376-9188 |

| Potential Consequences | Identity theft, financial fraud. |

| Prevention Tips | Be wary of unsolicited phone calls, never give out personal information over the phone |

| Reporting Info | Report to the Federal Trade Commission (FTC), relevant authorities and your phone service provider |

Conclusion

The Central Refund Department scam calls are designed to trick individuals and businesses into providing personal or financial information under the pretext of claiming refunds. Legitimate organizations do not initiate refund claims via unsolicited calls. Remain cautious, avoid sharing sensitive information, and educate yourself and your staff about the tactics used by scammers. By following these precautions, you can safeguard your business and personal information from falling victim to such scams.