⚠️ Have you received a text message claiming to be from Equifax alerting you to a sudden drop in your credit score? Beware, this could be the “Your Score Dropped” text scam designed to mislead you into visiting harmful websites.

Here’s the scenario: The scam involves text messages falsely claiming to be from Equifax. These messages allege a significant drop in your credit score and prompt you to take immediate action. They include links like “hxxp://doortimer.com/T31” or “hxxp://noortimer.com/safe”, which are supposedly related to your credit information. However, these links actually lead to fraudulent sites designed to steal your personal information or redirect you to other malicious websites.

The “Your Score Dropped” text message, with its urgent and alarming content, is a phishing scam. Despite appearing credible, it’s a deceitful tactic to entrap you. ❗ Remember, real alerts and information about your credit score come from official and trustworthy channels, not through unsolicited text messages. Be cautious of clicking on links in text messages from unexpected sources and maintain your digital security measures. Awareness of these scams is key to protecting your online safety.

Table of Contents

🚨 Is the “Your Score Dropped” Text Message a Scam?

Yes, the text messages falsely claiming to be from Equifax and alerting about a drop in your credit score are a Scam! 🚫. If you’ve received a text message alleging that your credit score has significantly dropped with a link to more information, exercise extreme caution. These messages are not legitimate alerts but are devised to exploit your concerns about financial security.

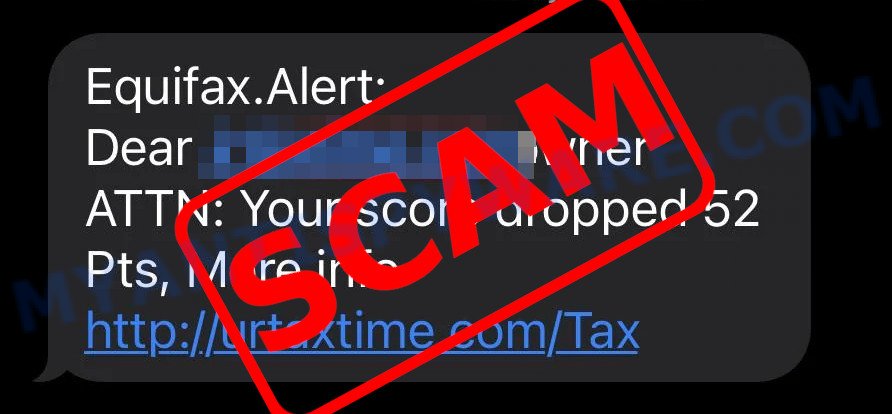

Fake texts examples:

- Equifax.Alert: Dear xxxxx owner ATTN: Your score dropped 31 Pts, More info http://[link]

- Equifax.Alert: Dear xxxxx owner ATTN: Your score dropped 52 Pts, More info http://[link]

- Equifax.Alert: Notice of Credit Score Change. Verify at http://[link]

- Equifax Alert: Your Credit Score Has Changed. Check Now http://[link]

The fraudulent links in these texts lead users to various fake websites designed to mimic legitimate credit information services or other credible sites. 🚨 The objective? To deceive you into providing personal information or directing you to other malicious websites. These sites may steal login details, personal data, or even manipulate users into subscribing to unwanted services. Remember: authentic alerts about your credit score are typically communicated through official channels and not via unsolicited text messages. Always verify such information through reliable sources before engaging with such content. 🛡️

🚩 Red Flags to Watch Out For:

Be cautious and confirm the authenticity of such messages through official sources if you encounter these warning signs. 🔍🛡️

- 📧 Urgent and Concerning Messages: Messages starting with alarming alerts like “Equifax.Alert: Your score dropped” use urgency and concern as tactics in these scams.

- 🔗 Suspicious Links: The message includes a link to an external website, often masquerading as a source of information about your credit score. Always inspect the link’s destination before clicking.

- ⏳ Immediate Calls to Action: The use of immediate calls to action, such as “More info”, aims to provoke quick concern and response.

- 🖼️ Misleading Appearances: Be wary of messages with links that falsely imply a connection to credit score information, which are in reality setups for phishing websites.

- ✍️ Language and Tone: These messages may use worrying language to capture attention, often lacking the authenticity of genuine communication from credit bureaus.

- 👤 Faux Legitimacy: The scam often imitates credible alerts, like those supposedly from Equifax, to instill a sense of legitimacy and trust.

- 🔄 Redirects to Phishing Sites: Legitimate credit information is usually accessible on official websites of credit bureaus, not through external links in text messages. Be wary of any message that redirects you away from familiar, trustworthy sources.

🕵️♂️ How the “Your Score Dropped” Text Scam Works

The “Your Score Dropped” text scam is a sophisticated form of social engineering that preys on users’ concerns about their credit status. Understanding its operation is crucial to protect yourself from falling victim to this deceptive tactic. 💡🔐

🚨 Urgency and Concern

The scam begins with a text message impersonating Equifax, alerting the recipient about a significant drop in their credit score. This tactic is designed to evoke a sense of urgency and concern, prompting users to click on a provided link without questioning its authenticity.

🔗 Deceptive Links

These scam texts include links that seem to offer information about your credit score but are actually fraudulent. The links often lead to websites that mimic authentic financial services, tricking users into believing they’re accessing legitimate information. The primary aim? To redirect users to counterfeit websites where the scam unfolds. It’s crucial to understand that genuine credit information is typically available on well-established financial platforms, not through obscure links in text messages.

Deceptive Links Examples:

- http://doortimer[.]com/T51

- http://noortimer[.]com/safe1

- http://urtaxtime[.]com/safe

- http://botinkr.com/T31

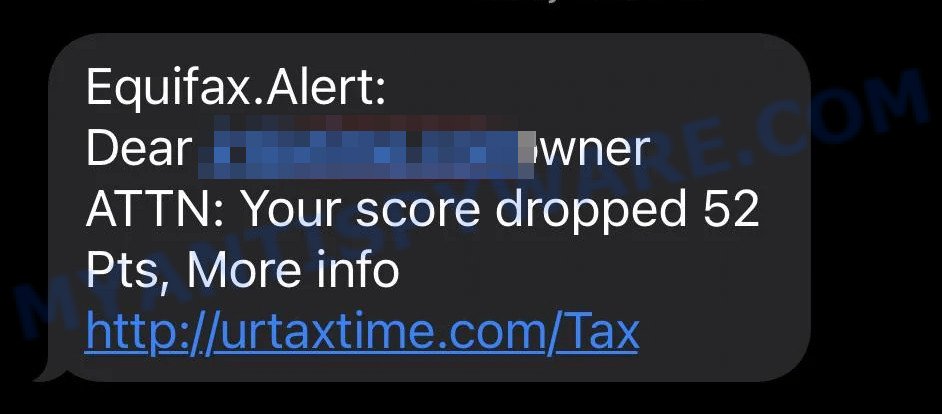

- http://doormany[.]com/tax

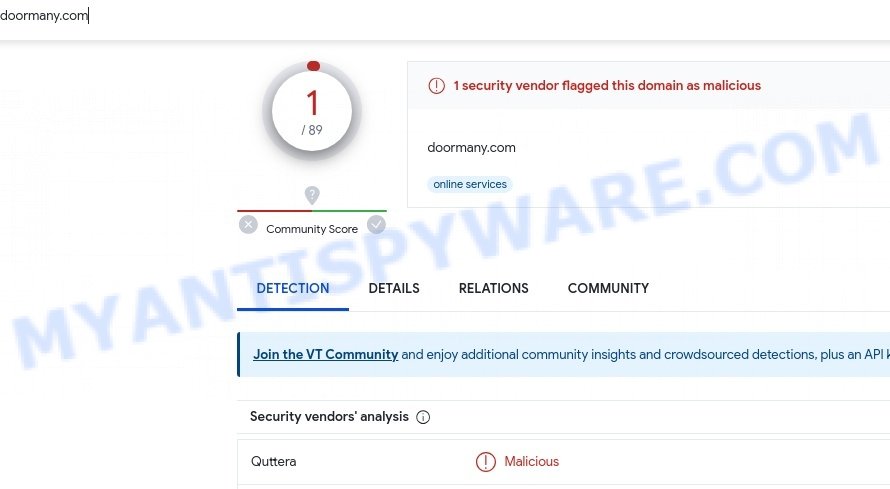

🎭 Phishing Websites and Malicious Redirects

Upon clicking, the link leads users to a site purporting to be about credit scoring or security alerts. However, these are fake setups designed to convince the user of the message’s legitimacy and encourage them to interact further, usually by entering personal information or being redirected to other malicious websites.

VirusTotal flagged a “Your Score Dropped” link as malicious:

📥 Phishing and Malware Risks

Interacting with these fraudulent sites poses various risks, including phishing attempts to capture personal and financial details, or redirection to websites that install malware. Users might be prompted to enter sensitive data or download files, jeopardizing their online security and privacy.

A fake ‘Attention EQUIFAX Affected Consumers’ alert:

📋 Data Harvesting and Subscription Traps

The scam may involve more than stealing personal details. It can entice users through deceptive steps like fake surveys or subscription offers to collect additional personal information for different forms of fraud or financial theft.

🔄 Illusion of Legitimacy

Throughout the interaction, the scam maintains its deception, providing users with false reassurances that they are accessing legitimate credit information or security alerts. This tactic keeps the user engaged and less likely to question the content’s authenticity, increasing their exposure to risks.

📢 Help Us Combat Scams: Report Your Experience!

If you’ve encountered the “Your Score Dropped” text message scam, we strongly encourage you to share your experience in the comments. Please include any details like the exact phrases used in the texts, the nature of the alerts, or the links to the scam websites. By sharing your story, you contribute to raising awareness about this scam, helping us track its prevalence, and potentially disrupt its deceptive operations. Your insights are crucial in our collective effort to combat online fraud. Together, we can keep our online community informed and safeguard against such phishing scams! 🛡️💬

What to Do If You Encounter the “Your Score Dropped” Text Scam

If you receive a text message from the “Your Score Dropped” scam falsely claiming to be from Equifax about a drop in your credit score, it’s crucial to act wisely to protect yourself and your personal information. This deceptive scam can be concerning, but being informed and proactive is your best defense. Here’s a guide on how to handle this situation effectively.

🚫🔗 Don’t Click Any Links

If you receive a text with claims about your credit score drop and a link to sites like “doortimer.com” or “noortimer.com”, do not click it. These links are the primary method scammers use to direct you to phishing websites.

🔐 Secure Your Accounts

As a precaution, consider changing your passwords for financial accounts and related services, especially if you have interacted with such a text. This helps ensure the security of your accounts.

📞 Verify Information through Reliable Sources

Before believing or acting on such alerts, verify your credit score and account status through official channels, like directly contacting Equifax or using their official website. Do not rely on unsolicited text messages for critical financial updates.

🚨 Report the Scam

Report the scam to your mobile carrier, and if possible, to organizations like the Federal Trade Commission (FTC) or your local consumer protection agency. This helps in identifying and taking action against such scams.

👥 Inform Your Contacts

If you’re aware of friends or family who might be susceptible to such scams, inform them about this deceptive tactic. Raising awareness is key to preventing the spread.

🔒 Use Security Measures

Consider using security measures like fraud alerts or credit freezes on your credit files. This adds an additional layer of protection against identity theft and unauthorized credit activities.

📰 Stay Informed

Keep yourself updated about common financial scams and phishing tactics. Following cybersecurity and financial security news can help you stay one step ahead of potential threats.

📌 How to Report the “Your Score Dropped” Text Scam?

If you receive the “Your Score Dropped” scam text message, it’s important to report it. Doing this helps keep you safe and also protects others from these deceptive practices. Here’s how you can report this scam:

🔍 Identify the Scam Text

Locate the text message that you suspect is part of the scam.

👉 Use Your Phone’s Reporting Feature

Most phones have an option to report a text message as spam or a scam. On many devices, this can be done by pressing and holding the message.

🚩 Select the Reporting Option

Choose the appropriate option to report the message. This could be “Report Spam” or “Report Message”.

📱 Contact Your Mobile Carrier

You can forward the suspicious text to 7726 (which spells “SPAM” on the keypad). This reports the message to your mobile carrier.

🔗 Report to Relevant Authorities

In some regions, you can report fraudulent messages to government bodies or consumer protection agencies. Check your local government website for more information on where to report.

🛡️ Additional Steps

If you’ve clicked on the link in the message, monitor your accounts for unusual activity and consider changing your passwords. You may also want to inform your financial institutions about the potential breach of your personal information.

✔️ Complete the Process

Follow any additional steps as directed by your phone, mobile carrier, or local authorities to finish reporting the scam.

Summary Table

| Name | “Your Score Dropped” Text Message Scam, False Equifax Credit Alert |

| Type | Phishing Scam, Identity Theft Risk |

| Damage | Risk of personal data theft, potential financial fraud, exposure to malicious websites and unwanted software subscriptions |

| Distribution | Text messages (SMS) impersonating Equifax, often sent to random or targeted phone numbers with alarming messages about credit score drops |

| Tactics | Fake Equifax alerts, urgent and specific messages about credit score decreases, deceptive links leading to various phishing sites |

| Scammers’ Websites | Fraudulent websites mimicking credit information services, with URLs such as doortimer.com, noortimer.com, urtaxtime.com, doormany.com, botinkr.com leading to phishing or other scams |

| Prevention Tips | Avoid clicking on links in unsolicited texts, verify credit score changes through official Equifax channels or other credible sources, educate others about this scam, maintain strong cybersecurity practices, be wary of specific and urgent credit alerts via SMS. |

| Reporting Info | Report suspicious texts to mobile carriers, notify Equifax of fraudulent use of their name, stay up-to-date with the latest scam trends to recognize similar fraudulent activities |

😱 Steps to Take If You’ve Been Tricked by the “Your Score Dropped” Text Scam

If you think you might have clicked on a link from the “Your Score Dropped” text scam, it’s important to stay calm and act swiftly. This scam targets your financial security fears through urgent and misleading texts that lead to dangerous links. To address this, here’s a clear set of steps you can follow to minimize potential harm and protect your information.

🔐 Immediate Password Change

Immediately change the passwords for any accounts that you fear may be compromised. This includes your financial accounts, email, and any other sensitive accounts, especially if you have used similar passwords.

👀 Monitor Financial and Credit Reports

Closely monitor your bank accounts and credit reports for any unusual activities. Scammers might use your personal information to commit identity theft or unauthorized transactions.

📞 Contact Your Financial Institutions

Get in touch with your bank and credit card companies. Inform them about the scam and any actions you may have taken after interacting with the message. They can offer specific advice to secure your accounts.

🔒 Enable Two-Factor Authentication

Activate two-factor authentication for your sensitive accounts. This adds an extra layer of security, safeguarding your accounts even if scammers have obtained some of your credentials.

🚫🔗 Inform Your Contacts

Warn your friends, family, and network about the scam. Advise them to be cautious of similar messages and not to trust unsolicited texts or links, especially those claiming to be from financial institutions.

📝 Document the Scam

Record evidence of the scam, such as screenshots of the message and any interactions you had. This documentation can be useful if you need to report the incident or for future reference in case of any disputes or investigations.

👮♀️ Report to Cybersecurity Authorities

Consider reporting the incident to local cybersecurity or law enforcement authorities. While online scams are common, reporting them can contribute to broader efforts to combat such malicious activities.

📘 Stay Informed and Educated

Regularly update yourself on the latest online scams. Staying informed helps you recognize and avoid falling victim to similar tactics in the future.

🎯 Conclusion

The “Your Score Dropped” Text Scam is a trick used by scammers. They play on your worries about money by sending fake texts pretending to be from Equifax, warning you that your credit score has dropped. The real goal? To trick you into clicking on bad links that take you to scam websites. This can lead to your personal info being stolen, getting caught up in more scams, and maybe even losing money.

It’s really important to remember that real info about your credit score or bank accounts usually comes straight from the bank or credit companies, not through random texts with links that look shady. The best way to stay safe from these scams is to be smart and careful. If you get a text that seems alarming about your finances, check it out first by calling your bank or checking their official website. Don’t just click on any link in a text, and let your friends and family know about these kinds of scams too. Changing your passwords often and using extra security steps like two-factor authentication are also good ways to keep your online stuff safe. 🛡️🌐