Have you received a call or text that says ‘You’ve been approved for a personal loan by Freedom Lending Services’? The message claims that you’ve been approved for a substantial loan at an unusually low interest rate. It urges you to call back quickly to secure the loan, often providing a number like 877-941-1150.

Question: Is it true that I’ve been approved for a loan, and should I follow up on this offer?

Investigation Findings: This type of message is commonly referred to as a “loan approval scam“. In reality, the scammers have no intention of offering you a loan. These messages are designed to trick you into providing personal information or paying upfront fees.

Answer: The ‘Freedom Lending Services’ message is a fraudulent scam. 💡 To protect yourself from such scams, do not respond to the messages or call back the numbers provided, like 877-941-1150. Always verify any loan offer by contacting the lender directly through official channels. It’s also wise to report these numbers to the authorities and block them on your phone.

Table of Contents

🚨 Is the Freedom Lending Services Loan Approval a Scam?

Yes, the text messages or calls claiming that you’ve been approved for a personal loan by Freedom Lending Services offering a significantly large amount at an incredibly low interest rate are indeed scams. 🚫 If you’ve received such a message or call, exercise extreme caution. The offers are too good to be true and are designed to instill urgency, misleading you into paying upfront fees or revealing sensitive information to the scammer.

A Freedom Lending Services Scam Call (Transcript):

Hello this is Emily with approval department at freedom lending services I’m calling to let you know that appears we can offer up to $60,000 with payment as low as $460 a month please give us a call as soon as possible at 877-941-1150 again our number is 87779411150

This scam involves fraudsters impersonating a legitimate lending service, claiming they have pre-approved you for a personal loan. However, legitimate financial experts and consumer protection agencies confirm that these claims are fraudulent. No real loan exists; the communication is designed to scam you out of money or personal information. Scammers send these messages and calls broadly, hoping to ensnare unsuspecting victims.

The fraudulent messages and calls often claim they have reviewed your financial situation and threaten to withdraw the offer unless you act quickly. They provide a phone number for you to contact and set a deadline to increase the urgency and pressure.

Unpacking the Freedom Lending Scam Tactics

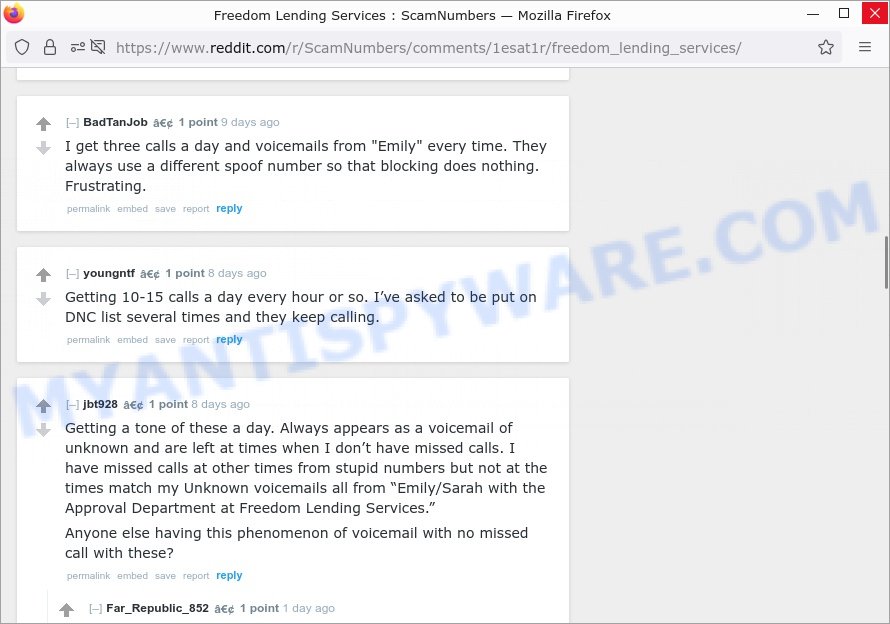

Research has demonstrated that in this scam, although each message or call may differ slightly, they often involve consistent elements designed to mimic legitimacy. For instance, scammers frequently use common names such as “Emily” or “Sarah” and maintain the same voice across different calls, as noted by multiple users on Reddit. All messages aim to create a sense of urgency, a tactic specifically designed to pressure potential victims into making hasty decisions.

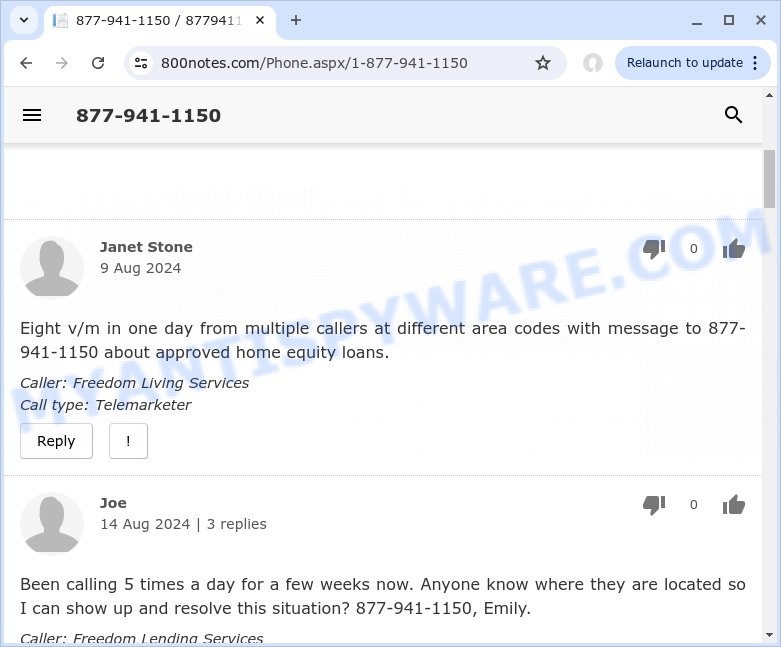

Victims often report that the scam messages and calls come from a wide range of phone numbers, utilizing caller ID spoofing techniques to evade detection and make it challenging for victims to block subsequent contacts. According to user feedback, this results in an endless cycle of calls, often ignoring requests to be placed on “Do Not Call” lists and using technology to leave voicemails without a direct call being recorded.

Furthermore, the strategy of frequently changing numbers complicates efforts for victims to track the origin or report the fraud accurately. For example, 800notes users report that the calls can occur several times a day, often leaving voicemails from numbers that have not appeared in their missed call logs.

Overall, this scam uses sophisticated methods to mimic legitimate business tactics while exploiting technological tools to maintain a relentless and deceptive campaign against potential victims.

🚩 Red Flags to Watch Out For:

To protect yourself, be aware of these warning signs of the scam: 🔍🛡️

- 📧 Too Good to Be True Offers: Unexpected messages or calls offering loans with unusually favorable terms.

- 💸 Upfront Payment Demands: Requests for payment of “processing fees” upfront, claiming it is necessary to secure the loan.

- ⏳ Urgency and Imposed Deadlines: These messages impose a tight deadline to pressure you into acting hastily, using fear of missing out on the loan to coerce you into paying immediately.

- 🔄 No Evidence of Legitimate Loan Approval: The messages provide no real evidence or documentation of the loan approval.

- 👤 Anonymity of the Contact: Scammers use various phone numbers and provide minimal or no contact information, making it difficult to verify the source.

- 🔗 Suspicious Claims: Be skeptical of any communication that makes extraordinary claims about loan approvals and demands for upfront fees.

💡 Never respond to such messages or calls or send money. Additionally, ensure your personal information is secure. If concerned, monitor your financial accounts closely for any unusual activity.

🕵️♂️ How the Freedom Lending Services Scam Works

The Freedom Lending Services scam is a deceptive scheme that bombards you with phone calls and texts claiming you have been approved for a large loan at an exceptionally low interest rate. Knowing how this scam operates is crucial for your safety. 💡🔐

🚨 Impersonating a Legitimate Company

This scam starts with persistent calls and messages from “Emily” or “Sarah” from the approval department of Freedom Lending Services, offering you up to $60k in loans. They exploit trust by mimicking a legitimate company’s name to convince you of their credibility.

🔗 Consistent and Repetitive Contact

Victims report receiving multiple calls a day, sometimes hourly, all from various spoofed numbers, making it difficult to block them. The consistency and frequency of these calls are designed to wear down your defenses and push you towards engaging with the scammers.

🎭 Use of Pressure Tactics

Scammers pressure you to act quickly by falsely claiming that the loan offer is time-sensitive and requires immediate action, often insisting on upfront “processing fees” to secure the supposedly favorable loan terms.

📥 Harvesting Personal Information

Upon engagement, they request personal details under the guise of verifying your identity or processing your application, aiming to steal your sensitive information.

🔄 Ignoring Do Not Call Requests

Even if you request to be removed from their call list, the calls continue unabated. This relentless approach is a hallmark of the scam, highlighting their disregard for legal compliance.

🕳️ Financial Loss and Disappearing Act

After victims provide the requested “processing fees” and personal information, the scammers typically cease communication, leaving individuals with financial losses and no way to recover the promised funds. The personal information collected is often used for further fraudulent activities, compounding the victim’s problems.

By understanding these tactics, you can better protect yourself from this and similar scams. Always verify the authenticity of any unsolicited financial offers through official channels and report persistent scam attempts to regulatory authorities.

📌 How to Report Freedom Lending Services Scam Calls and Texts

If you receive a call or text from Freedom Lending Services claiming you’ve been approved for a personal loan with low interest rates, be cautious—it’s likely a scam. Reporting it can help you stay safe and protect others. Here’s the simple way to report these scam calls and texts:

🔍 Spot the Scam Call or Text

Identify any call or text message that seems suspicious, particularly those that offer too-good-to-be-true loan terms or request upfront fees.

👉 Use Your Phone to Report

Most phones allow you to report a call or text as spam or scam directly from the call log or message thread. Press and hold on the scam message or call to access this feature.

🚩 Pick the Report Option

Choose the appropriate option to report the message or call. This could be “Report as Spam” or “Block & Report Spam”.

📱 Tell Your Mobile Company

Forward the scam text to 7726, which spells “SPAM”. This lets your mobile carrier know about the scam. For calls, inform your carrier directly through their customer service.

🔗 Tell the Authorities

Report scam calls and texts to the Federal Trade Commission (FTC) at [ReportFraud.ftc.gov](https://reportfraud.ftc.gov). You can also look up local or state consumer protection agencies to report this activity.

🛡️ What to Do Next

If you’ve responded to the scam text or call by providing personal information, monitor your financial accounts closely for any unusual activity. Consider changing your passwords and alerting your bank to potential fraud.

✔️ Finish Reporting

Ensure you complete all steps as advised by your phone carrier, the FTC, or local government agencies to fully report the scam.

Threat Summary

| Name | Freedom Lending Services Scam, Freedom Lending Loan Scam |

| Type | Phishing, Financial Fraud |

| Scam Text Content | Hello this is Emily with approval department at freedom lending services I’m calling to let you know that appears we can offer up to $60,000 with payment as low as $460 a month please give us a call as soon as possible at 877-941-1150 again our number is 87779411150 |

| Scammers’ Contacts (Numbers) | 877-941-1150 (commonly used for call-back) |

| Fake Fee | Processing fees required upfront, typically 1-2% of the loan amount |

| Targeted Information | Personal details (name, age, address), financial information (social security number, bank account details), payment for upfront fees |

| Harm | Financial loss through fees paid; potential identity theft |

| How It Spreads | Unsolicited text messages and phone calls from spoofed or varied phone numbers |

| Scammer’s Methods | Impersonating a legitimate lending service, creating a sense of urgency, requesting upfront payment for processing fees |

| Variations | Various loan amounts offered, use of different contact numbers and caller names (commonly “Emily” or “Sarah”) |

| Protection Tips | Verify any unsolicited loan offers directly with the lender using official contact information; never pay upfront fees for loans; be skeptical of offers that seem too good to be true |

| What To Do If You Receive A Scam Text | Do not respond to the number provided in the message; verify the authenticity of the loan offer through known, official channels; report the incident to authorities and your mobile carrier |

| Reporting Info | Report suspicious messages to your mobile carrier by forwarding them to 7726; inform the FTC at ReportFraud.ftc.gov; consider filing a police report if significant financial loss has occurred |

😱 What to Do If You’re Targeted by the Freedom Lending Services Scam

If you’ve been contacted by someone claiming to be from Freedom Lending Services offering a too-good-to-be-true loan, it’s important to act cautiously. Here are the steps to protect your personal and financial information effectively.

🔐 Immediate Password Change

Change the passwords for any accounts that you suspect may have been compromised through interaction with the scam. This is crucial for your financial accounts, email, and other sensitive platforms, particularly if you’ve used similar passwords across multiple sites.

👀 Monitor Financial and Credit Reports

Keep a close eye on your bank accounts and credit reports for any signs of unauthorized activity. Scammers may use your personal information for identity theft or other fraudulent transactions.

📞 Contact Your Financial Institutions

Inform your bank and credit card issuers about the scam. Explain any actions you’ve taken based on interactions with these fraudulent messages. Your financial institutions can help secure your accounts and monitor for suspicious activity.

🔒 Enable Two-Factor Authentication

Set up two-factor authentication on all your important accounts. This adds a layer of security, helping protect your accounts even if scammers have some of your personal details.

🚫🔗 Inform Your Contacts

Alert your friends, family, and colleagues about the scam. Advise them to be wary of unexpected loan offers or other unsolicited messages, particularly those that seem too good to be true.

📝 Document the Scam

Keep records of all communications related to the scam, including screenshots of texts, emails, and any phone numbers used by the scammers. This information can be valuable for reporting the scam and for any future legal actions or investigations.

👮♀️ Report to Authorities

Report the incident to the Federal Trade Commission, local law enforcement, and other relevant cybersecurity authorities. Reporting helps combat these scams and may prevent others from becoming victims.

📘 Stay Informed and Educated

Keep yourself updated about new and ongoing scams. Being informed is your best defense against becoming a victim of similar schemes in the future.

🎯 Conclusion

The Freedom Lending Services loan approval message is a phishing scam. The fraudsters behind this scam use the name of a legitimate company, Freedom Lending, to send messages claiming you’ve been approved for a personal loan with exceptionally low interest rates. What is their goal? To entice you into paying upfront “processing” fees or providing personal information under the guise of verifying your eligibility. Falling for this scam can lead to financial loss and the theft of your personal and financial information.

It’s important to understand that real loan offers usually come after an application process, not through unsolicited texts or calls with too-good-to-be-true promises. If you receive an unexpected message about a loan or any money-related issue, it’s key to verify its authenticity by contacting the lender directly using contact information from their official website, not numbers provided in the unsolicited message.

Avoid responding to unsolicited loan offers, and inform your friends and family about these scams. Keeping your personal information secure and being skeptical of unsolicited communications can significantly protect you from such scams. 🛡️