The Mini Mobile ATM scam is a risky scheme that deceives people with unrealistic promises of turning their phones into money machines using a “2-Minute Phone Trick”. This scam is advertised heavily on social media, claiming that everyday people can make easy money from home. The website, minimobileatm.com, uses tricks like AI-voiced videos and deceptive badges to lure users into trusting its false claims.

This scam is designed to take your money by selling a digital course, promising you new income opportunities. For $47, they offer unlimited access to the course, claiming you can easily create an online business. However, the site has a disclaimer stating that results vary, and they don’t guarantee success. Even if the course offers a 60-day refund, many find it hard to get their money back.

💡 If you see ads promoting this kind of ‘quick money’ trick, don’t fall for it. Protect yourself by not visiting such sites or buying their products. Always remember, if something sounds too good to be true, it probably is. Be smart and vigilant online!

Table of Contents

🚨 Scam Overview

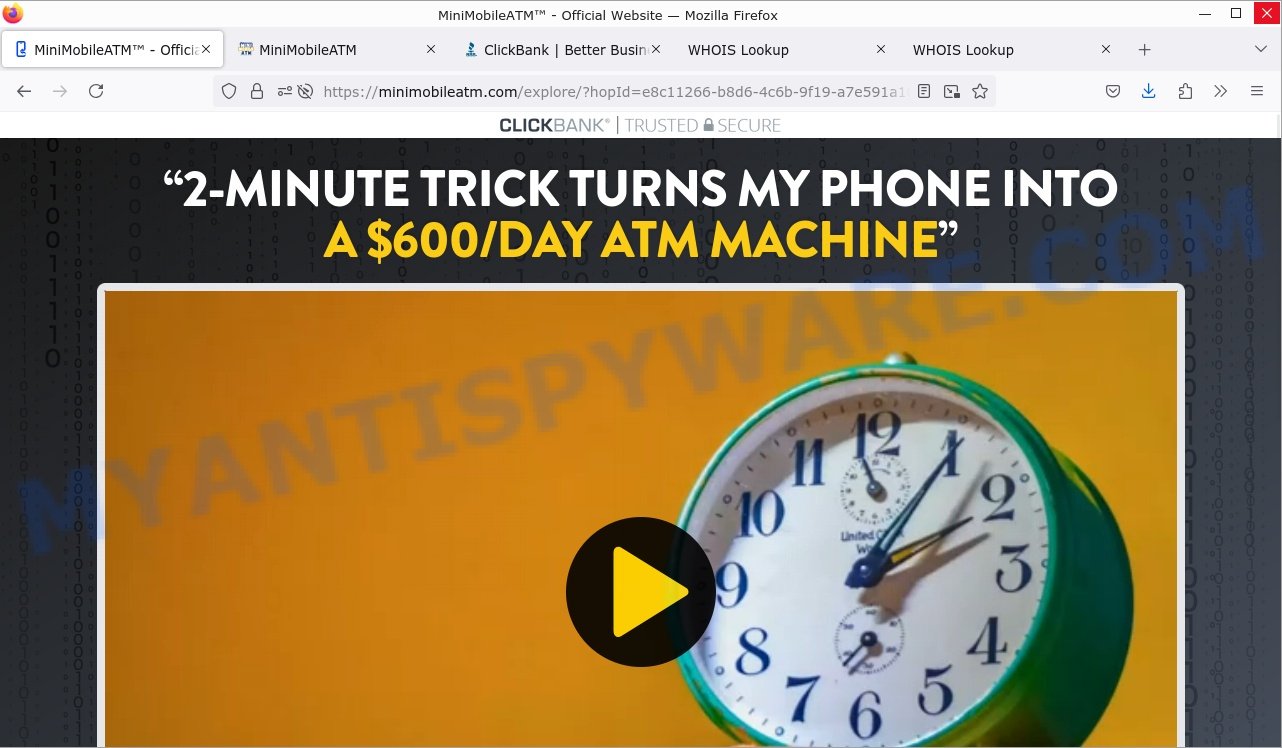

The Mini Mobile ATM Scam, involving the deceptive “2-Minute Phone Trick,” is a widespread scheme circulating on social media. It uses fabricated success stories and misleading advertisements to entice people into believing they can easily convert their phones into personal ATM machines. This scam particularly targets users across Facebook, Instagram, and TikTok, presenting itself as a golden opportunity for easy money with minimal effort.

The scam ads read as follows:

#1:

Have You Seen The “2-Minute Phone ATM Trick”?

Everyday people are turning their phones into personal ATM machines thanks to this breakthrough “2-Minute Phone Trick”… But how?

Every single day, billions of dollars flow through the internet. It’s like a digital gold rush that never ends ($730B and growing)….

2 MINUTE

PHONE TRICK

MINIMOBILEATM.COM

This 2-Min Phone Trick Had My Mom Quit Her Job

🚩 Signs of the Scam

- Fabricated Success Stories: The scam uses fake testimonials from individuals claiming significant earnings with little to no effort using the Mini Mobile ATM.

- Promises of Easy Income: Ads that entice users with claims of making over $600 daily by simply leveraging their mobile phones.

- Links to Suspicious Websites: Advertisements lead users to sites like minimobileatm.com for more deceptive information.

- Upfront Payment Requests: These sites demand a one-time fee of $47 to access the supposed income-generating program.

- Hidden and Recurring Fees: Victims report unexpected additional charges, including unauthorized recurring charges on their credit cards.

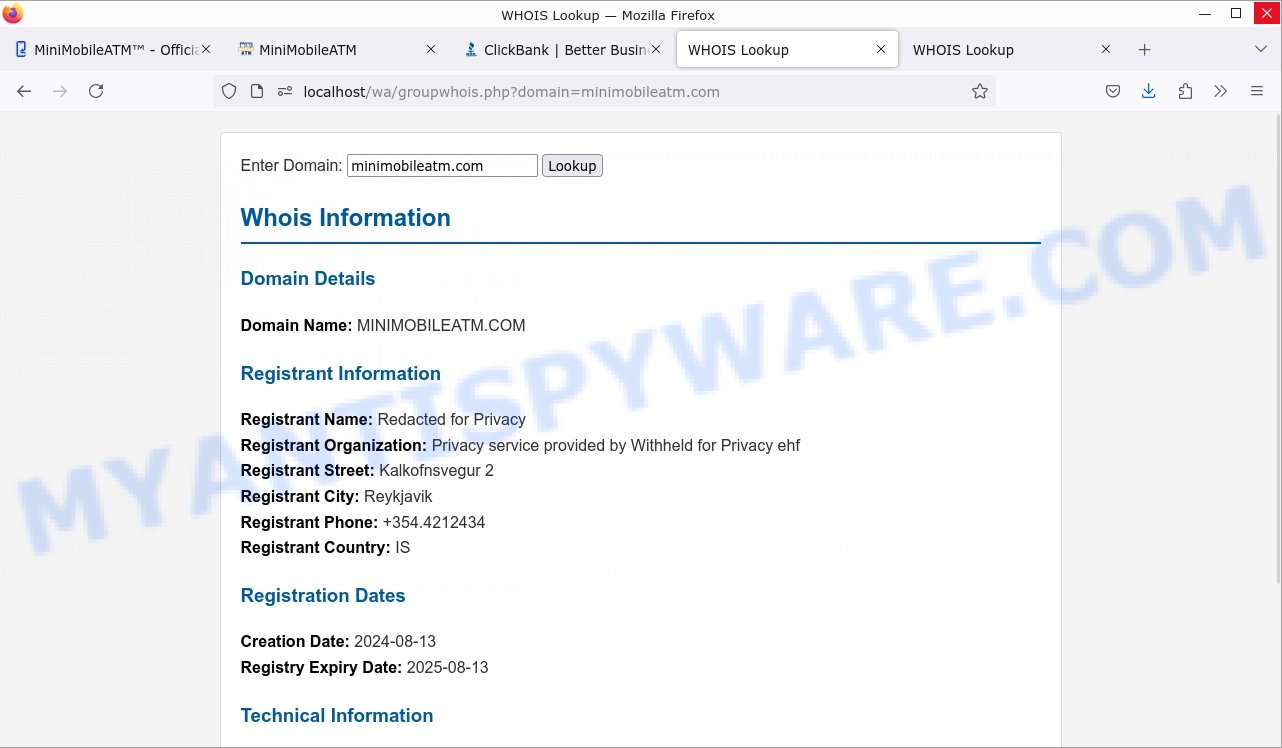

- Lack of Transparency: WHOIS information for the involved domains is hidden, with registrant details redacted and often located in jurisdictions that obscure true ownership, like Reykjavik, Iceland.

- Use of AI-Generated Content: The scam’s websites feature videos narrated by AI voices that use aliases, adding a layer of deception.

- Vague and Generic Instructions: After payment, users receive unclear and generic instructions that provide no real value or unique insight.

In summary, the Mini Mobile ATM Scam with the “2-Minute Phone Trick” is an elaborate fraud exploiting fake success stories, misleading ads, and deceptive websites to trick individuals into paying for a non-existent money-making scheme. It promises effortless income through an alluring mobile phone trick, redirects victims to dubious websites, and ensnares them with hidden fees and vague promises. Victims are left with unauthorized charges, not the financial windfall they were promised, underscoring the need for vigilance and skepticism towards online offers that seem too good to be true.

🕵️♂️ How the Mini Mobile ATM Scam Works

The Mini Mobile ATM scam is a misleading scheme that has become increasingly prevalent across social media platforms. Central to this scam is the use of deceptive advertisements promoting a “2-Minute Phone Trick”, falsely claiming that users can turn their phones into personal ATM machines capable of generating $600 per day. These ads lure people into visiting scam websites where they’re duped into paying a one-time fee of $47, under the guise of accessing an easy money-making system.

🔗 Social Media Ads

Scammers deploy ads on social media platforms such as Facebook, TikTok, and Instagram, using alluring headlines like “2-Minute Phone ATM Trick” or “This 2-minute trick makes me hundreds of $$$ every day”. These ads often feature made-up success stories, such as the narrative of a person who supposedly turned their financial life around using the trick after learning about it through an online friend, leading to immediate and significant financial gains. Users, deceived into believing these ads are legitimate, are enticed to click on them.

📰 Fake Landing Pages

The social media ads direct to sham websites like minimobileatm.com, which host videos and promotional content falsely claiming to offer a revolutionary income-generating system. These websites are designed to look professional, with convincing headlines and persuasive details to enhance the scam’s credibility. For example, minimobileatm.com features a video with the message:

2-MINUTE TRICK TURNS MY PHONE INTO A $600/DAY ATM MACHINE”

MINI MOBILE ATM

One that turns my phone into a Mini Mobile ATM

📊 Fabricated Success Stories

On these fraudulent websites, users find stories about individuals who allegedly started earning substantial income rapidly after using the Mini Mobile ATM system. These stories are entirely fabricated and serve to build trust and make the scam appear more legitimate. The stories often highlight how easy it is to generate income with minimal effort, convincing users to proceed with the purchase.

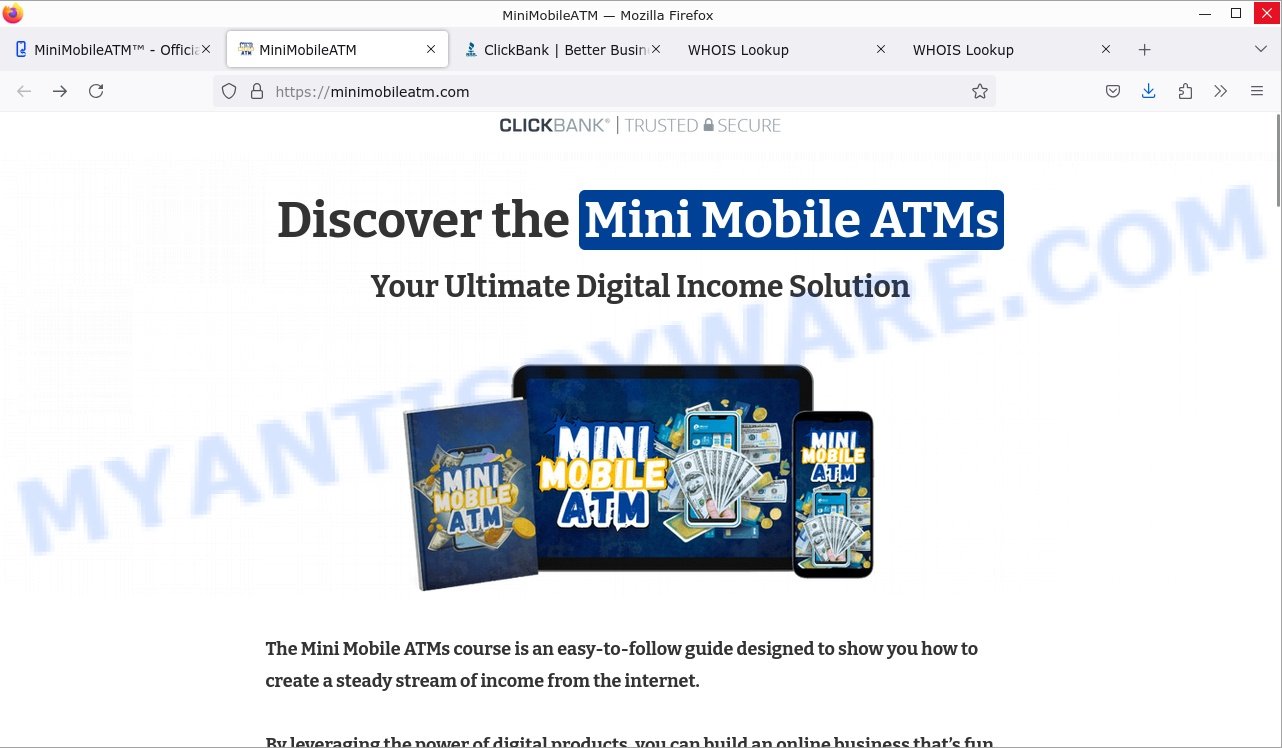

🎉 Redirect to the Payment Page

After watching the initial video, users are prompted to click a link that takes them to a payment page. Here, the Mini Mobile ATM is presented as a comprehensive digital income solution designed to help users easily generate money from the internet by leveraging digital products. The site emphasizes strategies like creating and selling information products and tapping into digital markets without spending on ads, further misleading users into believing in the program’s effectiveness.

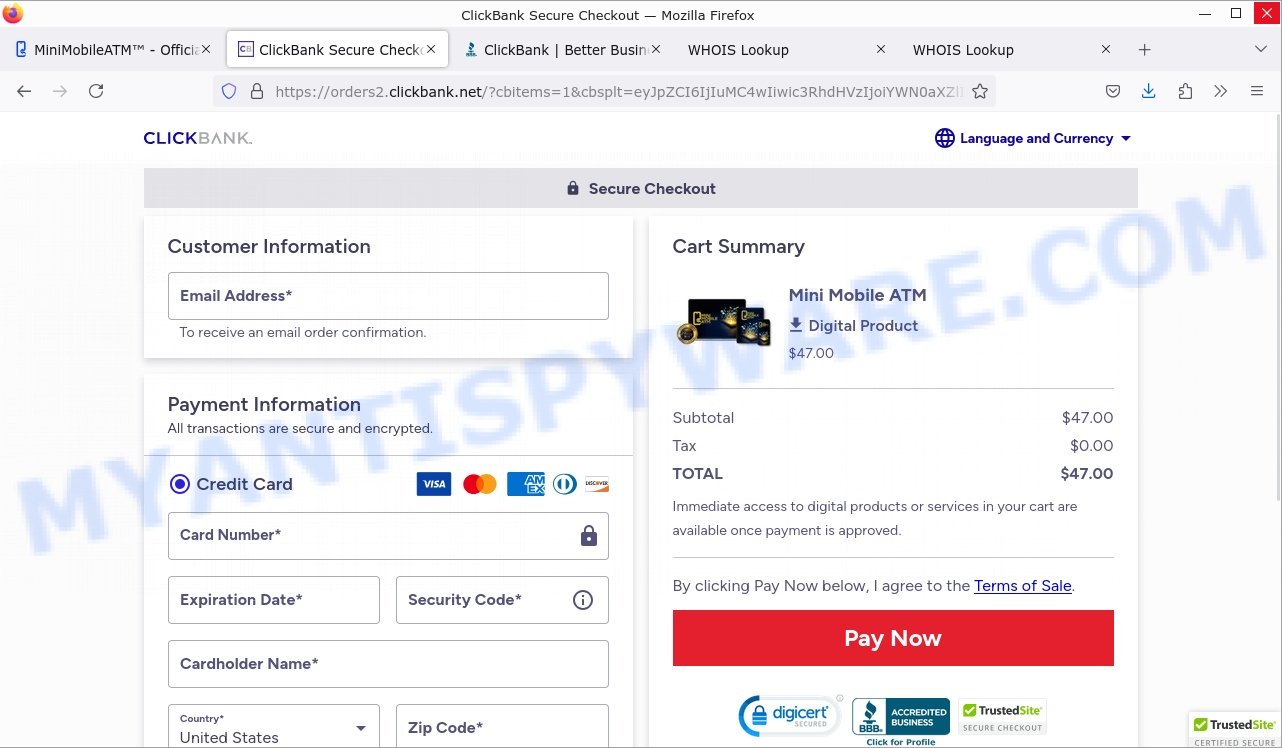

🛍️ Attempting to Purchase the Program

Enticed by the promises, users decide to purchase the Mini Mobile ATM program for a one-time fee of $47. Upon attempting the purchase, they are directed to a payment site that processes payments through ClickBank. This step is misleading, as users expect access to a legitimate money-making system but instead receive vague instructions and no real value.

💳 Hidden Fees and Misleading Claims

Victims report being disappointed by the lack of promised results and finding that the content provided is generic and doesn’t offer any unique or proprietary advantage, similar to freely available resources. This tactic entraps users into spending their money without delivering any of the promised benefits.

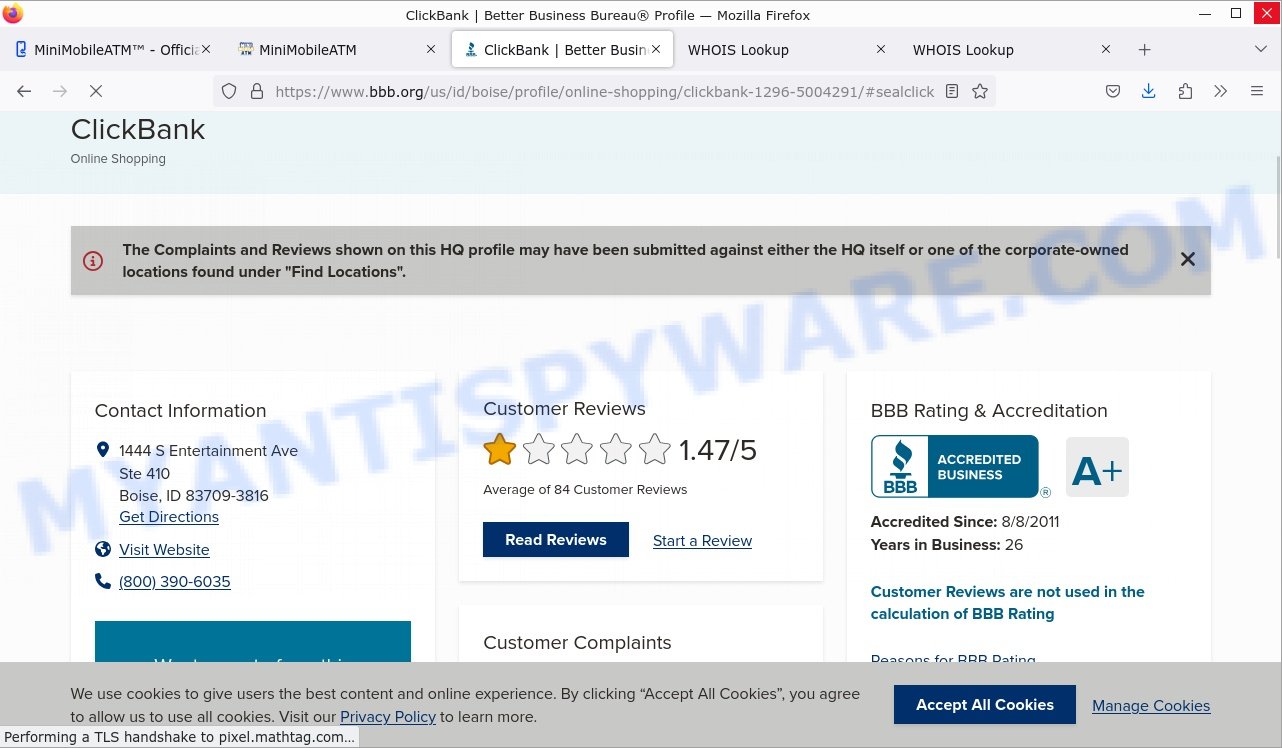

🌐 ClickBank’s Role and BBB Rating

Payments for the Mini Mobile ATM program are processed through ClickBank, a well-known digital marketplace. While ClickBank itself is a legitimate platform, its involvement is often used by scammers to lend a veneer of credibility to their schemes. It’s important to note that ClickBank’s BBB rating is relatively low; as of now, it holds a customer rating of 1.47 out of 5 stars. This rating reflects numerous customer complaints, primarily concerning issues with refunds and the quality of the products sold through their platform.

📑 WHOIS information

The WHOIS information for minimobileatm.com shows that the domain is registered privately, with registrant information hidden and located in Reykjavik, Iceland—a common tactic among scam operators to avoid being traced.

To stay safe, always be skeptical of offers that seem overly generous, and verify any promotions through official and recognized channels. Refrain from sharing personal or financial information on questionable platforms.

💡 Beware of Similar Scams

Scams like the Mini Mobile ATM money-making program and its “2-Minute Phone Trick” are not isolated incidents. They are part of a broader pattern of online fraud targeting individuals seeking easy income through simple and seemingly effective methods. Other notable examples include the “60-second phone loophole”, the “Pocket Sized ATM Machine” and the “7-minute phone trick”, which similarly promise quick and effortless earnings but ultimately deceive users with hidden fees, fabricated success stories, and lack of genuine value.

😱 What to Do If Scammed

If you’ve been caught up in the Mini Mobile ATM scam, don’t panic. It’s important to act quickly to protect yourself and your finances. Here’s a step-by-step guide on what to do next:

🏦 Contact Your Financial Institution

Immediately inform your bank or credit card company about the unauthorized transaction. They may be able to stop the transaction, reverse it, or even issue a chargeback. Request a new credit/debit card if you believe your card details have been compromised. Document any financial losses. This can be essential for investigations and potential reimbursements.

🔐 Change Passwords

If you suspect your personal information, especially passwords, have been compromised, change them immediately. This is crucial for accounts linked to financial institutions or personal data. Consider using a reputable password manager to ensure strong, unique passwords for each account.

👀 Monitor Your Accounts

Keep a close eye on your bank and credit card statements for the next several months. Look for any unauthorized or suspicious transactions, no matter how small. Consider enrolling in a credit monitoring service. Some services will alert you to changes in your credit report, potentially indicating identity theft.

🚔 Report the Scam

If you encountered scam ads on Facebook, Instagram, TikTok or other platforms, report them so they can be removed.

💻 Check Your Computer

If you’ve downloaded any file or clicked on any links, your device might be infected. Run a comprehensive antivirus scan.

📘 Educate Yourself

Familiarize yourself with common scam tactics to avoid falling victim in the future. Stay updated on recent scams or phishing methods by following news sources or official government warnings.

📢 Inform Others

Warn friends and family about the scam, especially if it’s widespread. Sharing your experience can help protect others from the same pitfalls.

Summary Table

| Name | Mini Mobile ATM Scam: The 2-Minute Phone Trick |

| Type | Online Money-Making Scam |

| Fake Claims | Turn your phone into a personal ATM machine using a “2-Minute Phone Trick” for a fee of $47. |

| Disguise | The scam is disguised using overhyped success stories, AI-generated voices, and sophisticated-looking websites that mimic legitimate financial freedom guides. |

| Scammers’ websites | Websites like minimobileatm.com, which host enticing but vague videos and instructions on purported methods to earn money. |

| Credit Card Charge | Initial payment of $47, with potential for additional unauthorized charges reported by some users. |

| Damage | Victims pay the initial fee and may face further unauthorized charges, gaining nothing but access to ineffective and non-exclusive content. |

| Distribution | Distributed through social media platforms like Facebook, Instagram, and TikTok using captivating ads with headlines like “Turn Your Phone into an ATM” or “2-Minute Trick for Constant Cash” |

| Indicators of the scam | Use of AI-generated narration, anonymous domain registrations, and the absence of promised services on legitimate app stores; plus, non-specific and generic post-payment instructions. |

| Prevention Tips | Verify the legitimacy of such offers, check for product or service reviews, be skeptical of quick-profit claims, and avoid upfront payments without clear understanding of the product. Always use trusted and transparent payment channels. |

| Reporting Info | Report suspicious ads and activities directly on social media; For any unauthorized charges, contact your bank promptly; In the U.S., reports can be made to the Federal Trade Commission (FTC) at reportfraud.ftc.gov. |

Conclusion

The Mini Mobile ATM Scam is a deceptive online fraud targeting individuals seeking easy income. Leveraging the popularity of social media platforms, scammers entice users with promises of turning their phones into personal ATM machines through a “2-Minute Phone Trick”. Victims are lured into paying a $47 fee for access to the Mini Mobile ATMs course, which ultimately provides vague and unhelpful information without any actionable value. The scammers operate through fraudulent websites like minimobileatm.com, which are newly registered and hide their ownership details.

This scheme underscores the critical need for caution and thorough examination of online offers, especially those requiring upfront payments and making unrealistic promises. Always verify the authenticity of such promotions by researching reviews from credible sources and being wary of unsolicited claims of easy money. Remember, if something sounds too good to be true, it probably is. Stay informed and protect yourself from falling victim to online scams like the Mini Mobile ATM Scam and the “2-Minute Phone Trick”.

Great information about. Mini Mobile. So knowing that I got hacked, I have another question for you. Have you checked out? ” LottoMoney”? I’d be interested in finding out what you come up with. Thanks again from Tim Atchison.